The benefits of Salary Sacrifice:

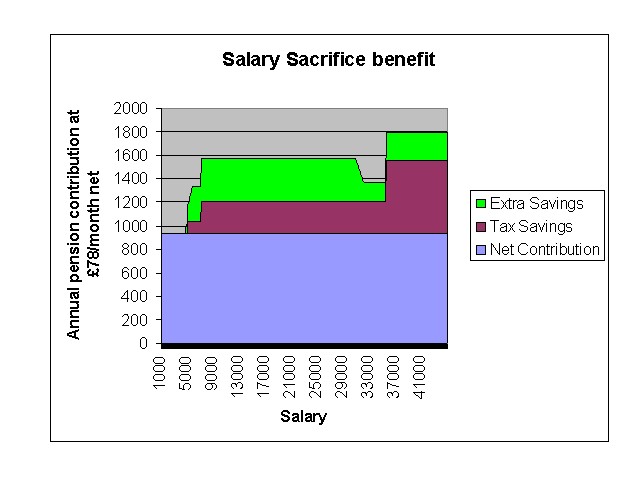

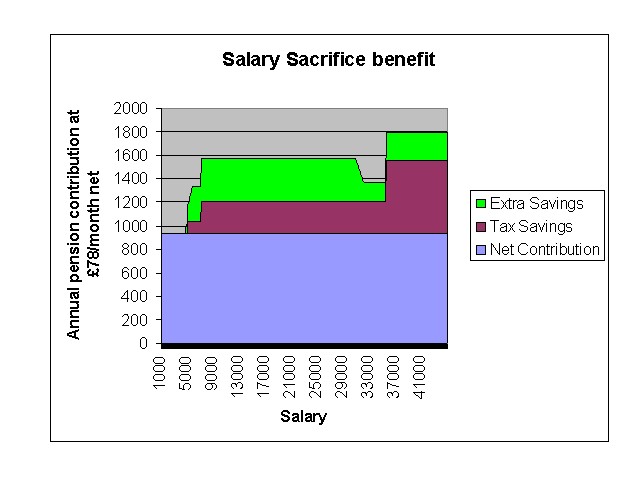

This graph was derived by using the algorithms embedded in GPP Manager software, set for the allowances and tax bands declared for 2003.

This example is for an employee contributing £78 per month into a personal pension plan. In the graph below, the net pension is the blue area, £936 per year. The plum-coloured band clearly shows the 10, 22 and 40% tax-band benefit reclaimable against income tax. The green band is the extra savings that can be made by employing a salary sacrifice arrangement within a Group Personal Pension plan.

These "extra savings" which derive from savings made on employer and employee National Insurance contributions as well as income tax can add up to 31.2% to the contributions into the pension fund for standard-rate taxpayers - a very useful and painless way of boosting pension returns. The current threat to pensions caused by the falling stock-market makes optimisation of your fund contributions extra important!